Are We Recession Bound Again Sf

thirty+ Years of Housing Marketplace Cycles Recessions, Recoveries, Booms, Bubbles

in the San Francisco Bay Expanse

& Adjustments (Sometimes Crashes)

by Patrick Carlisle, Compass principal market analyst, SF Bay Surface area

Below is a look at the past 30+ years of San Francisco Bay Area real estate boom and bust cycles. Financial-market place cycles have been around for hundreds of years, from the Dutch tulip mania of the 1600'south through today'south speculative frenzy in digital-currencies. While hereafter cycles will vary in their details, the causes, effects and trend lines are often quite similar. Looking at cycles gives u.s.a. more context to how the market works over time and where information technology may exist going -- much more dwelling in the immediacy of the nowadays with excitable pronouncements of "The market'south crashing and won't recover in our lifetimes!" or "The market's crazy hot and the only place it tin can go is upwardly!"

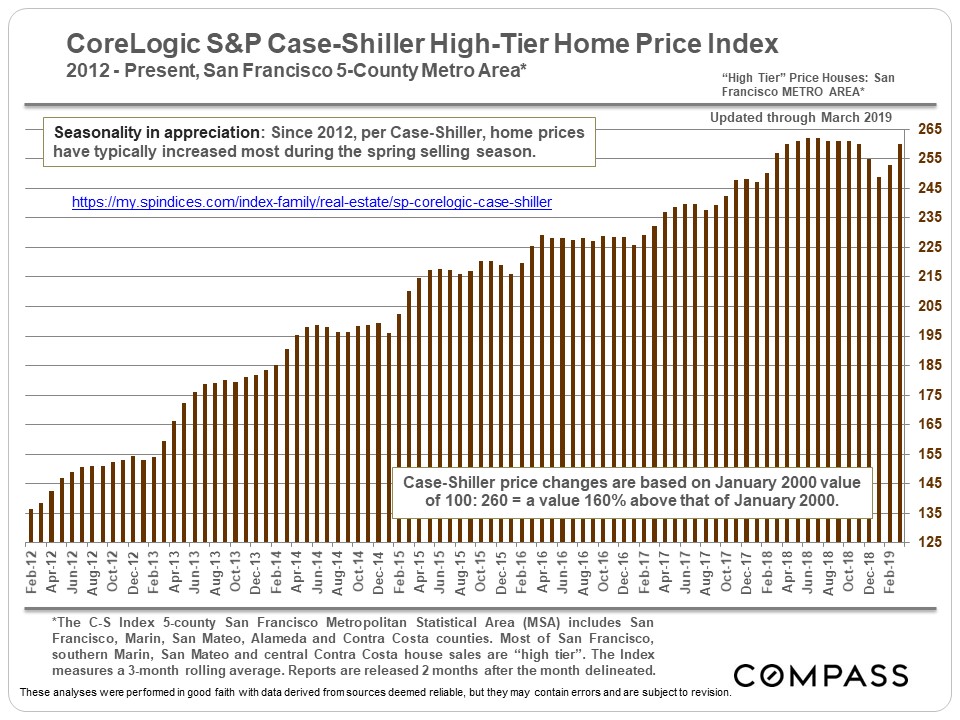

Note: Virtually of these charts mostly utilize to higher-priced Bay Area housing markets, such equally those found in much of San Francisco, Marin, Primal Contra Costa (Lamorinda & Diablo Valley) and San Mateo Counties. (Unlike market cost segments had bubbles, crashes - or adjustments - and recoveries of differing magnitudes in the last cycle, which is addressed at the end of this written report.)

Regardless of how contempo cycles have played out, it is vital to sympathize how extremely difficult information technology is to predict when dissimilar parts of a cycle will begin or end. Example in betoken: In 2012, a Nobel-Prize-winning economist stated that habitation prices might non recover "in our lifetimes," when in fact, the recovery had already (just) begun. In late 2015, when financial markets entered into a menses of nasty volatility, IPO activeness stopped in its tracks, and high-tech hiring slowed, a well-respected Berkeley economist prophesied at that place would shortly exist "blood in the streets" of San Francisco - nonetheless the market recovered and grew significantly more than heated through mid-2018. Boom times can go on much longer than expected, or get 2d winds. Even when the financial markets enter a period of "irrational exuberance," that menses tin proceed much longer than seems possible, with huge jumps in home and/or stock values.On the other hand, negative shocks can appear with startling suddenness, triggered by unexpected economic, political or even ecological events that hammer conviction, quickly spinning optimism into fright. (The world has become staggeringly complex and interconnected, with a huge number of spinning plates at any given time.) This can lead to other market dominoes falling, the reversal of positive trends in growth, investment and employment, which may then balloon into a menstruum of decline, recession, stagnation. These negative adjustments can be of varying scale. They can exist in the nature of an extended merely temporary period of loftier financial-market volatility and investor circumspection, such every bit caused by the Chinese stock market drib/oil price crash/Brexit vote in mid-2015 through mid-2016. It tin can be a definitive, era-defining financial-market crash or speculative bubble bursting, such equally in 2008. Or the downwards bike can occur gradually, like a slow leak in an over-pumped football game.

As of early March, it is non yet known which category the coronavirus - a true "blackness swan" event - volition fall into, whether a dramatic, just relatively temporary period high volatility, or the trigger for a plunge into an extended marketplace recession in stock and housing values.

Going back thousands or fifty-fifty tens of thousands of years, human beings have tried to predict the future, and whether using priests, oracles, astrologers, pundits, economists, analysts or "experts" of every stripe - and currently having their "administrative" forecasts headlined every day in the media - nosotros show no aptitude equally a species for having the ability to do so with any accuracy. We can't fifty-fifty remember the mistakes of the recent by - which is one reason why we don't seem to exist able to escape cycles - much less foretell what'south going to happen tomorrow.

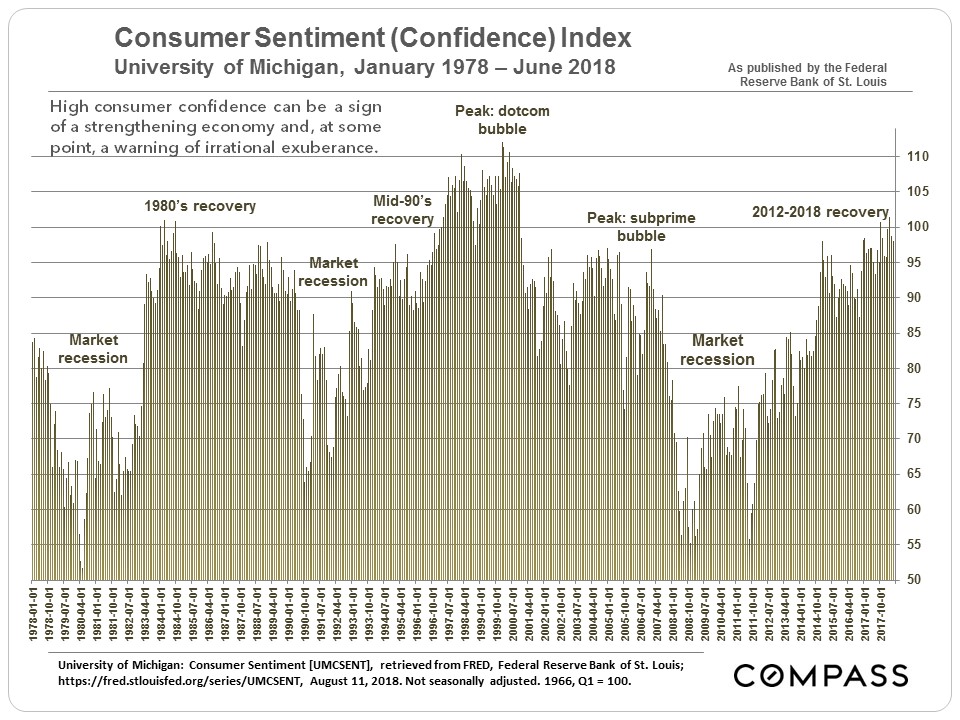

Confidence plays an enormous role in fiscal and real estate markets, and in every menses of irrational exuberance, there are many who vociferously argue that the exuberance is NOT irrational. Unfortunately, it can be very challenging to determine the signal at which rational confidence shifts into irrational exuberance, but when irrational exuberance abruptly shifts into fright, a stampede for the exits tin follow - every bit an one-time English saying puts information technology: "They run all away, and cry, 'the devil take the hindmost'." In retrospect, the duration of periods of irrational exuberance, when market gains often accelerate into the stratosphere, seems utterly incomprehensible. Such are the pleasures of hindsight. All the major recessions in the Bay Area in recent decades take been tied to national or international economic crises, which can take a wide diversity of forms. Absent an enormous natural disaster, it is unlikely that a major, negative market adjustment (or "crash") would occur due simply to local issues. Notwithstanding, local issues tin certainly lead to less dramatic market adjustments, or exacerbate a downturn acquired by a macro-economic event. The SF earthquake of 1989 intensified the national recession that began at that time; our greater exposure to dotcom beginning-ups did the same with the national dotcom-bubble/Nasdaq crash.Up, Down, Flat, Upward, Down, Flat...(Repeat)

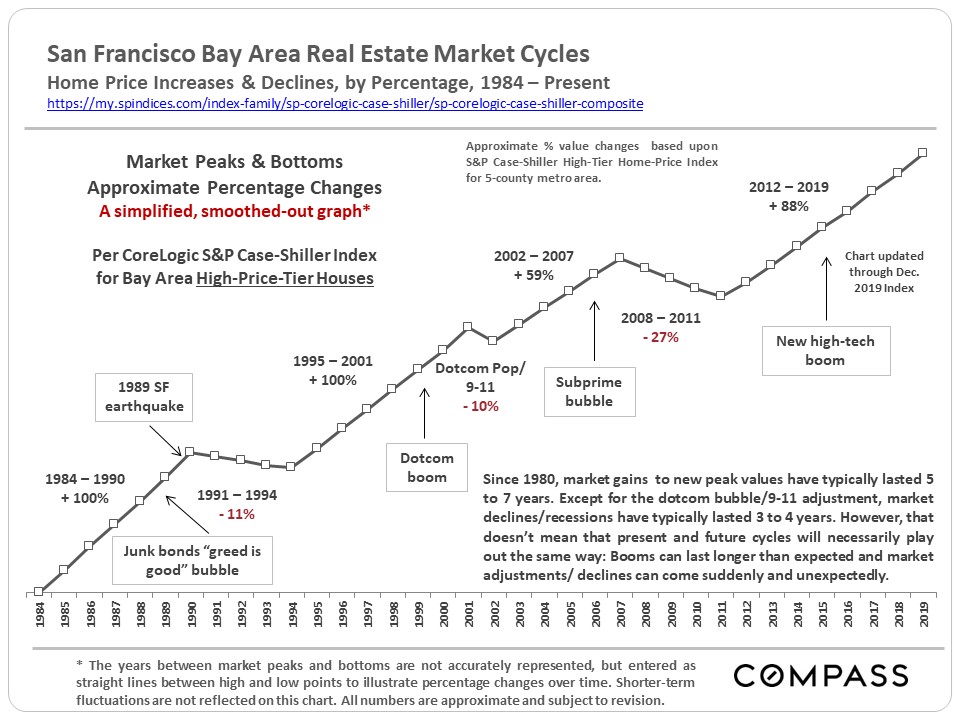

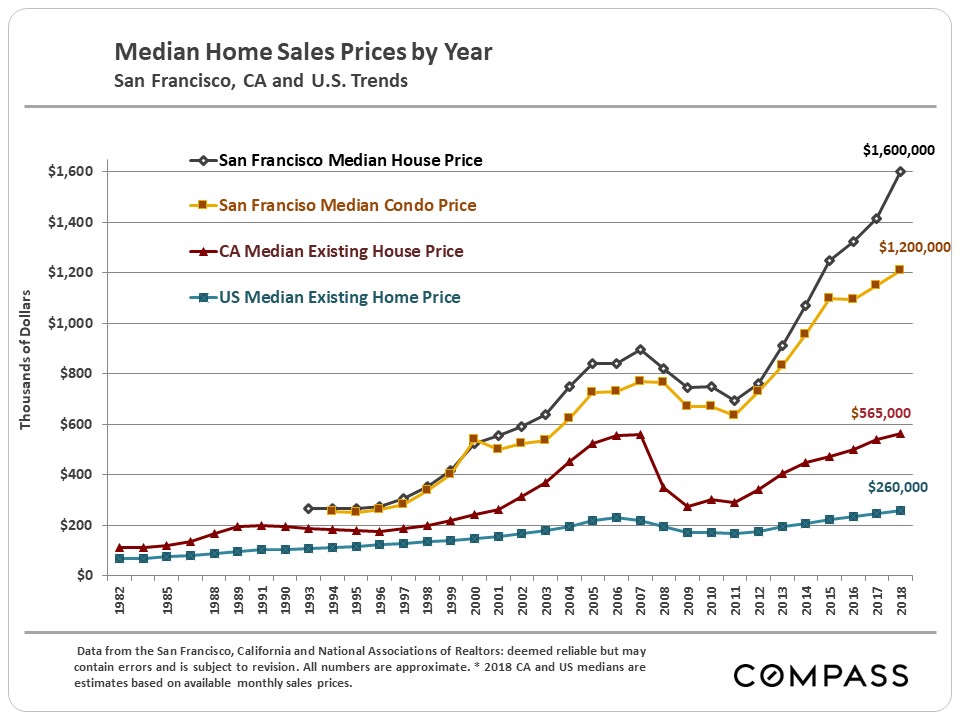

Smoothing out the bumps - temporary periods of volatility with their ups and downs - delivers the simplified overview to a higher place for the past 30 years. Any the phase of the bicycle, up or downwards, while it is going on people think it will concluding forever. Going upwards, "The globe is different at present, the rules accept changed, and in that location's no reason why the up-cycle can't continue indefinitely." Well, it turns out that the rules practise indeed all the same apply and up-cycles always end. So when the marketplace turns and goes down: "Homeownership has ever been a terrible investment and the market place probably won't recover for decades" (or even "in our lifetimes" every bit the Nobel-Prize-winning economist said in 2012). But the economy mends, the population grows, people start families, inflation builds up over the years, and repressed demand of those who want to own their own homes builds upwards. In the early on eighties, mid-nineties and in 2012, after about 4 years of a recessionary housing marketplace, this repressed need jumped back in (or "explodes" might be a proficient description) and prices started to rise over again. (The dotcom bubble aligning acquired a hiccup, but no lasting recession in dwelling house values.)

The nature of cycles is to keep turning.

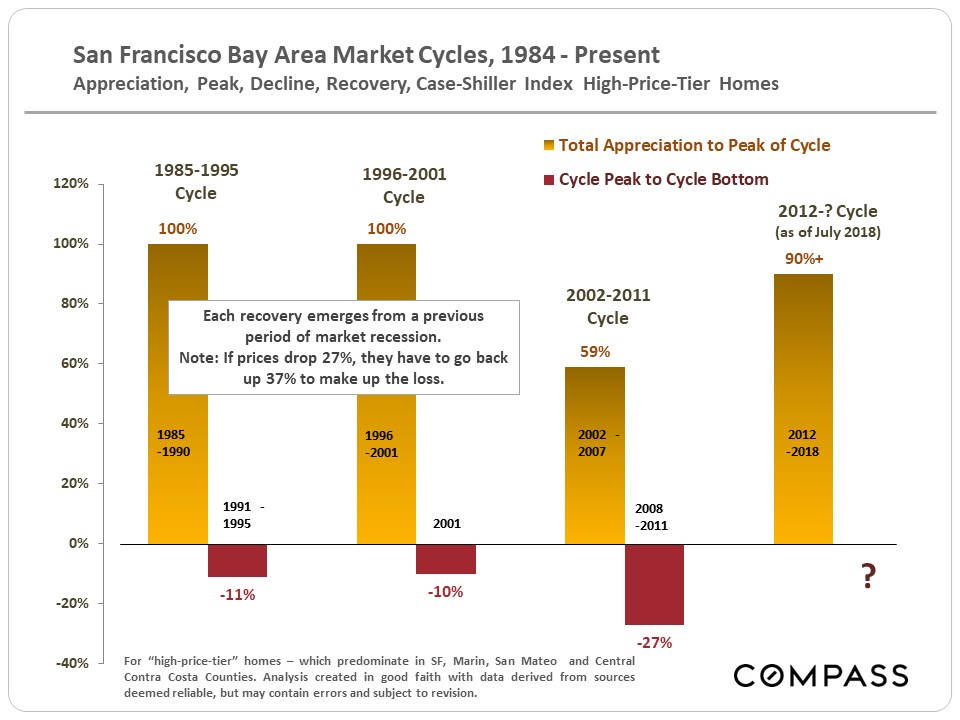

All bubbles are ultimately based on irrational exuberance, delinquent greed, criminal beliefs or, non uncommonly, all three mashed together. Whether exemplified by junk bonds, stock market hysteria, avid on untenable levels of debt, a corporate ponzi-scheme mentality, an abandonment of reasonable hazard assessment, and/or incomprehensible or quack financial engineering, the bubble is relentlessly pumped bigger and tighter - awaiting the trigger issue that will play the function of pin. And since human being beings announced utterly unable or unwilling to learn the lessons of past cycles, it is kind of like the movie "Groundhog Mean solar day," except that in the picture at to the lowest degree, Nib Murray actually grew wiser over time. The 2008 crash was truly abnormal in its calibration, and much greater than other downturns going back to the Keen Depression. The 2005-2007 bubble was fueled by domicile buying and refinancing with unaffordable amounts of debt on a staggering level, promoted by predatory lending practices, promises of endless appreciation, and an bottomless turn down in underwriting standards - and so eagerly facilitated by smug, rapacious, Wall Street flimflammery and self-abasing credit ratings agencies. Millions came to own homes they could never afford to pay for and the rot was distributed throughout the financial system. The market adjustments of the early 1990'south and early-2000's saw declines in Bay Area home values in the range of 10% to eleven%, which were bad enough, but nothing compared to the terrible 2008 - 2011 declines of 20% to lx%. This is important context when contemplating the next adjustment: It doesn't take to exist a devastating crash. It can be more like some air beingness let out of an over-pressurized tire instead of a blowout on the highway at loftier speed. It depends on many different factors. Link to new report, updated for pandemic: Bay Area Market Cycles since 1990, by County

Over the past 30+ years, the period between a recovery beginning and a bubble popping (or a bottom adjustment occurring) has run 5 to 7 years. We are currently about 5 years into the current recovery, which started in early 2012 (in San Francisco; later in outlying Bay Area counties). Periods of market recession/doldrums following the popping of a bubble have typically lasted about three-4 years. (The 2001 dotcom bubble/ 9-11 crisis driblet being the exception.) Generally speaking, within about two-3 years of a new recovery commencing, previous acme values (i.e. those at the height of the previous chimera) are re-attained -- amid other reasons, there is the recapture of inflation during the doldrums years. In this current recovery, those homes hit hardest by the subprime loan crisis -- typically housing at the lowest end of the cost scale in the less affluent neighborhoods, which experienced by far the biggest chimera and biggest crash -- are appreciating speedily now, and just kickoff to re-attain previous superlative values. However, communities with college priced homes -- such as in San Francisco, Marin, San Mateo and Central Contra Costa Counties (Diablo Valley & Lamorinda) -- accept surged well past their previous peaks.

This does not mean that these recently recurring time periods necessarily reverberate some natural police in housing market cycles, or that they can be relied upon to predict the hereafter. Real estate markets can be affected by a bewildering number of local, national and international economic, political and even natural-result factors that are exceedingly hard or even impossible to predict with any accuracy.

As long as ane doesn't have to sell during a down bicycle, Bay Area homeownership has near always been a good or even spectacular investment (though admittedly if 1 does accept to sell at the bottom of the market, the results tin be very painful). This is due to the ability to finance ane'due south purchase (and refinance when rates drib), taxation benefits, the gradual pay-off of the mortgage (the "forced savings" upshot), inflation and long-term appreciation trends. The best style to overcome cycles is to buy a home for the longer term, one whose monthly cost is readily affordable for yous, ideally using a long-term, fixed-rate loan.

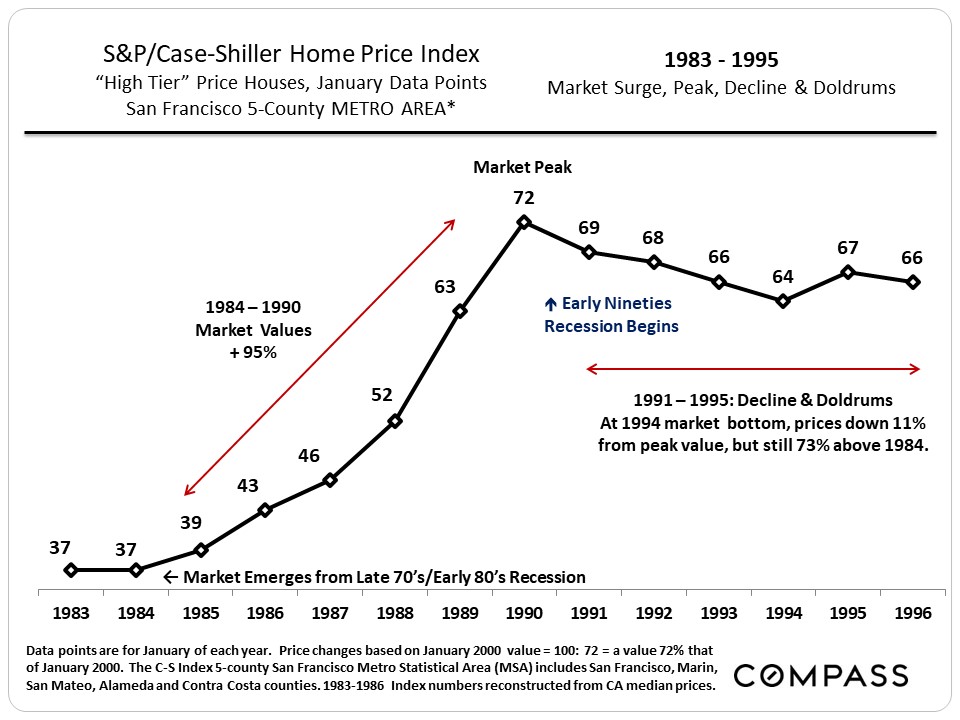

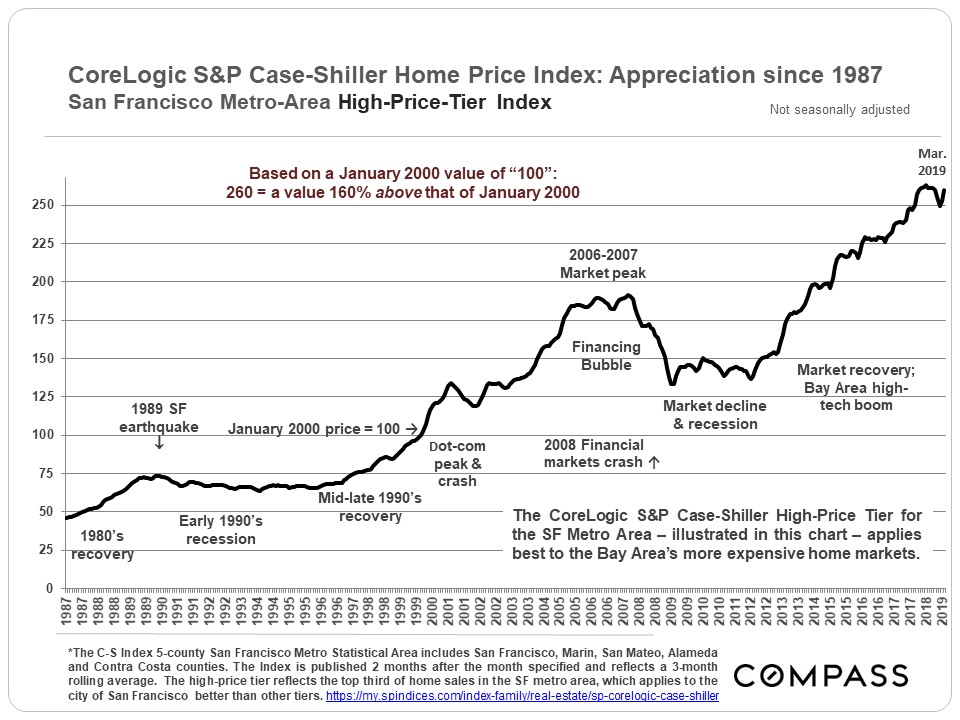

(After Recession) Blast, Decline, Doldrums

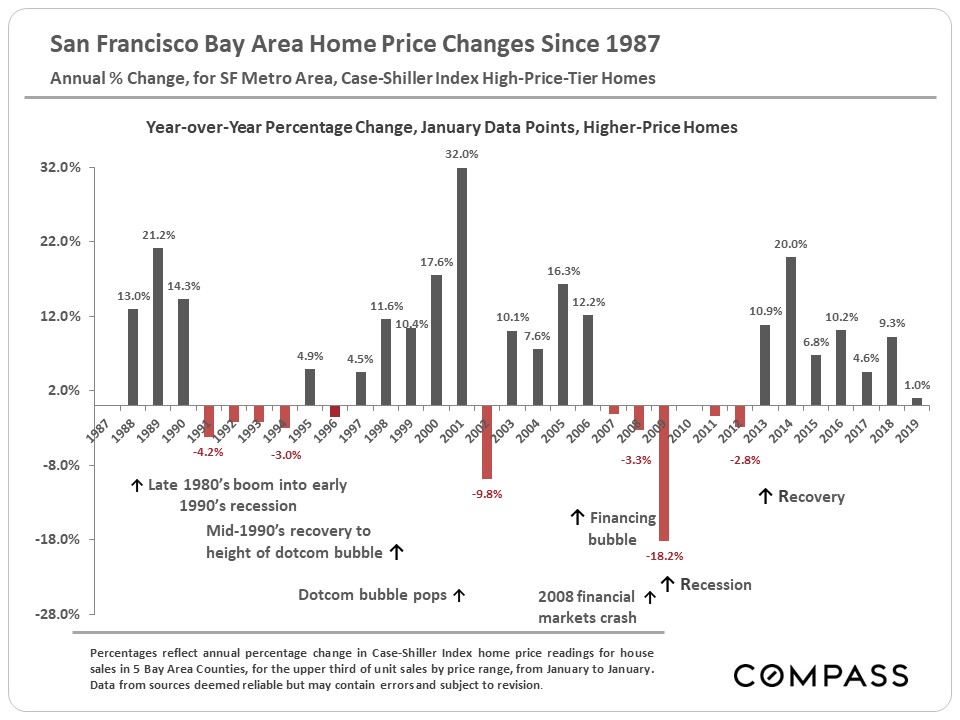

In the higher up chart, the country is simply coming out of the late seventies, early on eighties recession featuring terrible aggrandizement, stagnant economy ("stagflation") and incredibly high involvement rates (hit 18%). As the economy recovered, the housing market started to appreciate and this surge in values began to advance deeper into the decade. Over 6 years, the market appreciated well-nigh 100%. Finally, the late eighties "Greed is expert!" version of irrational exuberance -- junk bonds, stock marketplace swindles, the Savings & Loan implosion, equally well as the tardily 1989 earthquake here in the Bay Area -- ended the party.

Recession arrived, home prices sank about xi%, sales action plunged and the market stayed basically apartment for four to 5 years. Still, even after the decline, home values were 70% higher than when the boom began in 1984.

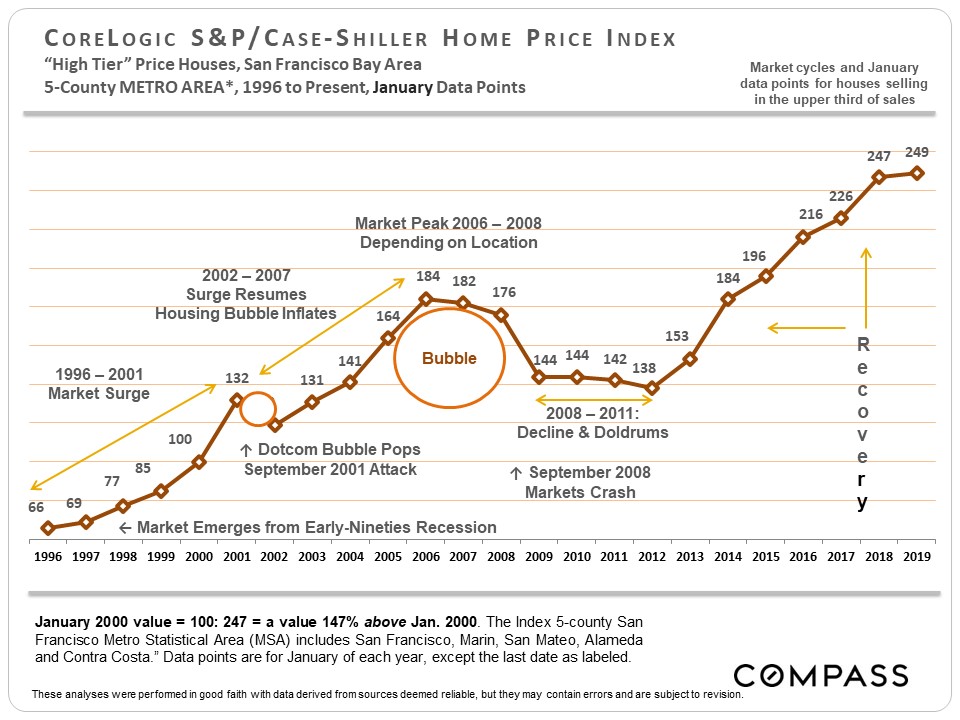

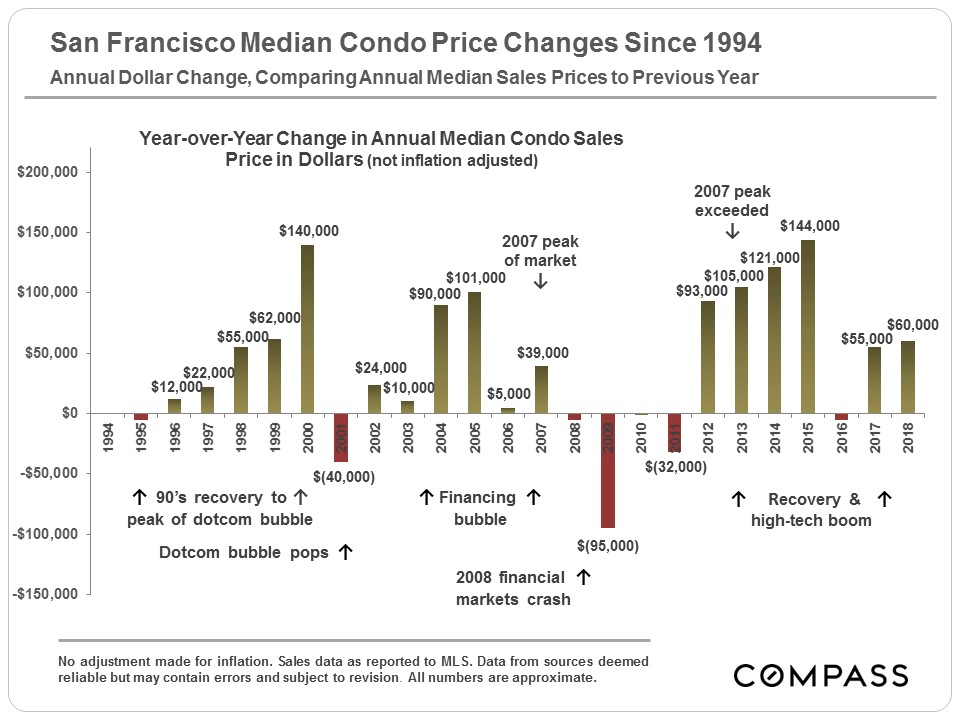

(After Recession) Nail, Bubble, Crash, Doldrums, Recovery

This side by side cycle looks similar but elongated. In 1996, later on years of recession, the market of a sudden took off and continued to accelerate til 2001. The dotcom chimera popular and September 2001 attacks created a market hiccup (a curt-term ten% decline, simply only for loftier-price tier houses, and for condos), but then the subprime and refinance insanity, degraded loan underwriting standards, mortgage securitization, and claims that existent estate values never decline, super-charged a housing bubble. Overall, from 1996 to 2006/2008, the marketplace went through an astounding flow of appreciation. (Different areas striking peak values at times from 2006 to early 2008.) The air started to go out of some markets in 2006-2007, and in September 2008 came the financial markets crash.

Across the land, domicile values typically fell xx% to 60%, tiptop to bottom, depending on the area and how badly it was affected by foreclosures -- nearly of San Francisco, with relatively few foreclosures, got off comparatively lightly with declines in the 15% to 25% range. The least flush areas got hammered hardest past distressed sales and toll declines; the most affluent were usually least affected. So the market stayed apartment for about 4 years, admitting with a few short-term fluctuations. Tied to a apace recovering economy, supply and need dynamics began to significantly alter in San Francisco in mid-2011, leading to the market recovery of 2012.

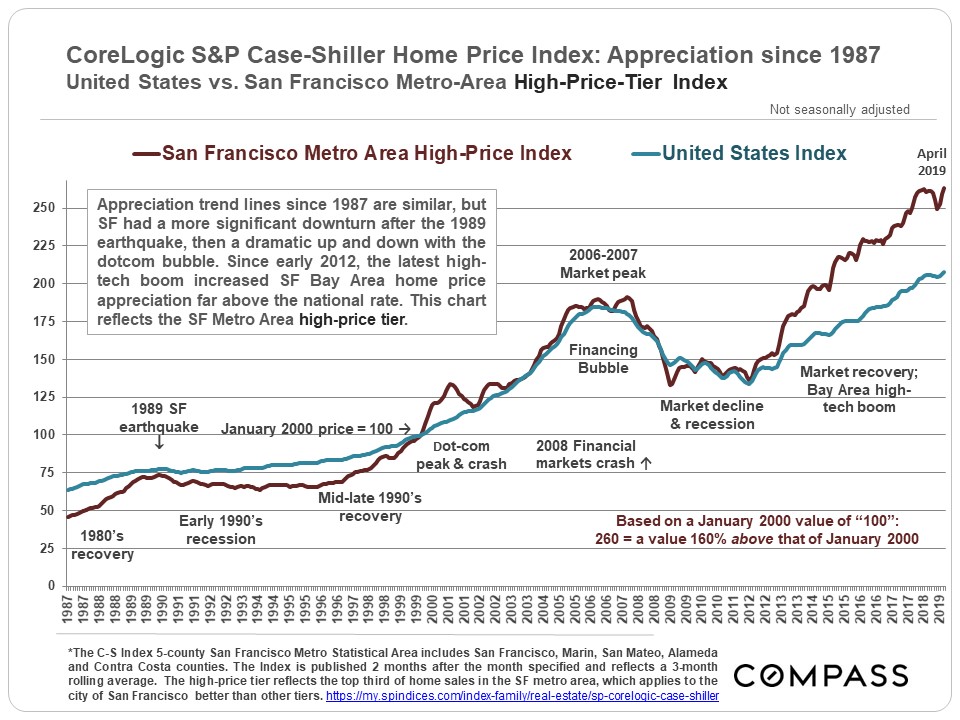

The Panorama: From the tardily 1980's to Present

The Panorama: From the tardily 1980's to Present S&P Instance-Shiller Alphabetize, 5-County SF Metro Surface area

Home Price Appreciation Trends since 1987

******************************

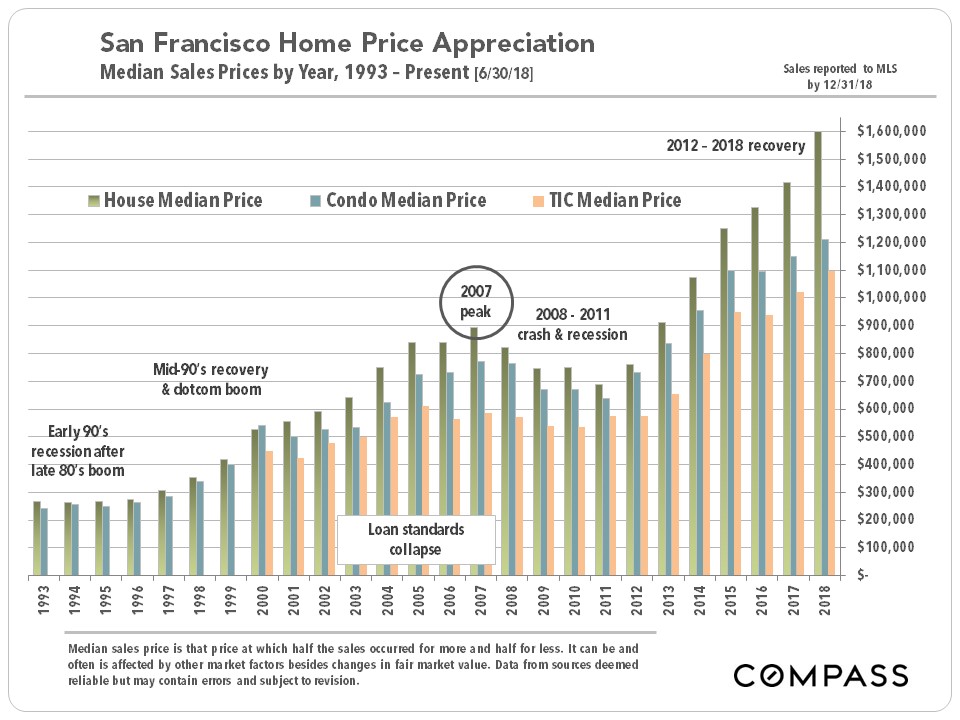

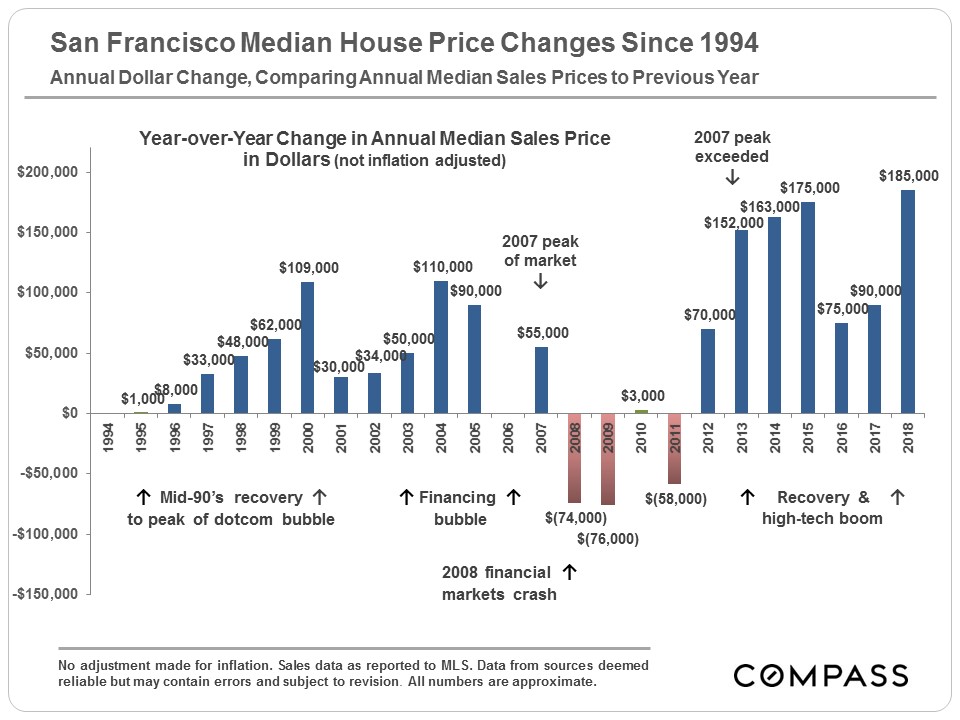

San Francisco Median Sales Price Appreciation

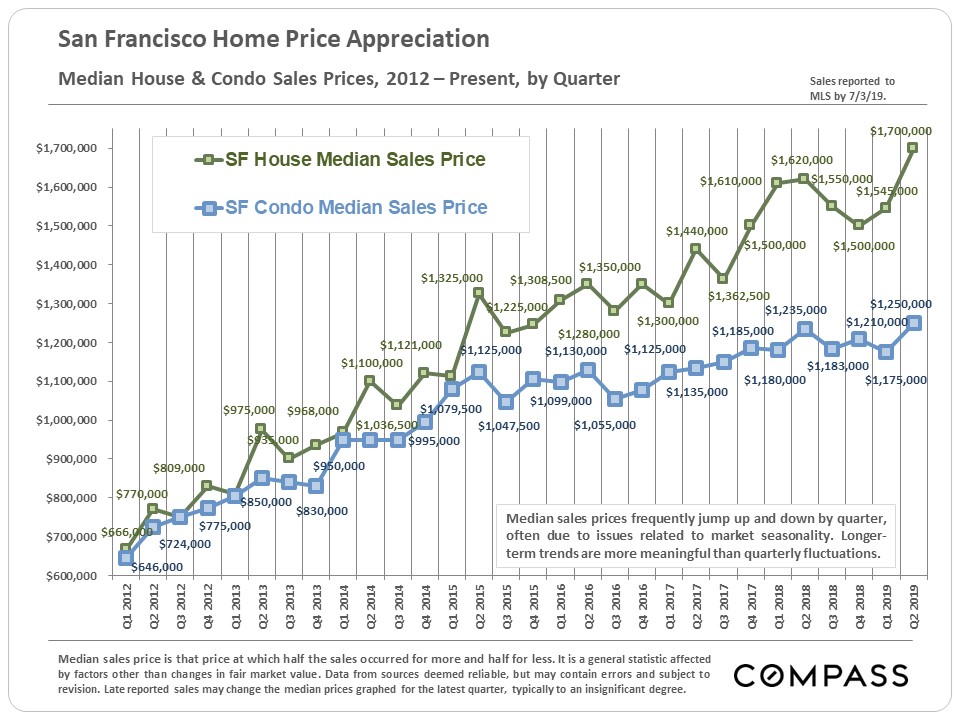

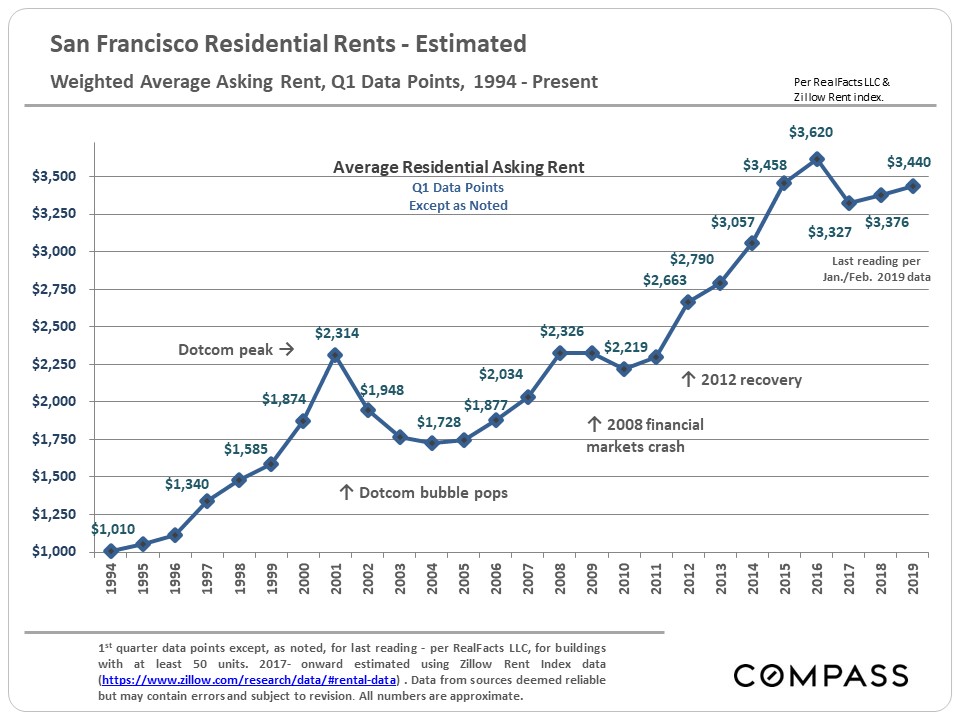

In 2011, San Francisco began to show signs of perking up. An improving economy, soaring rents, low involvement rates and growing buyer need coupled with a low inventory of listings began to put upwards pressure on prices. In 2012, as in 1996, the market abruptly grew frenzied with competitive behest. The city's affluent neighborhoods led the recovery, and those considered particularly desirable by newly wealthy, high-tech workers showed the largest gains. However, virtually the entire metropolis shortly followed to experience like rapid cost appreciation.

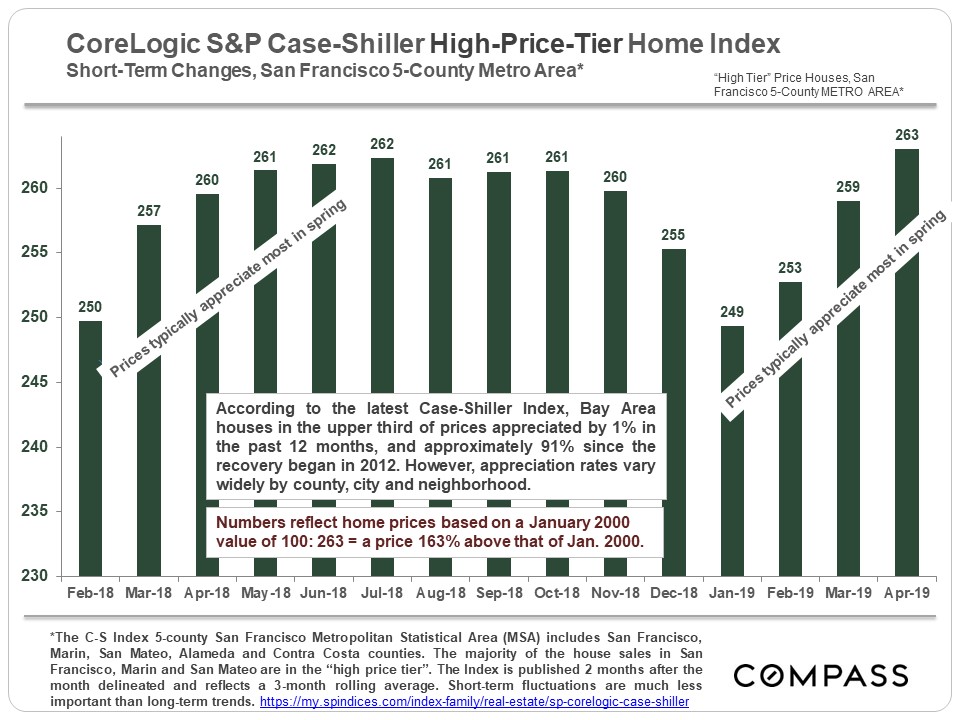

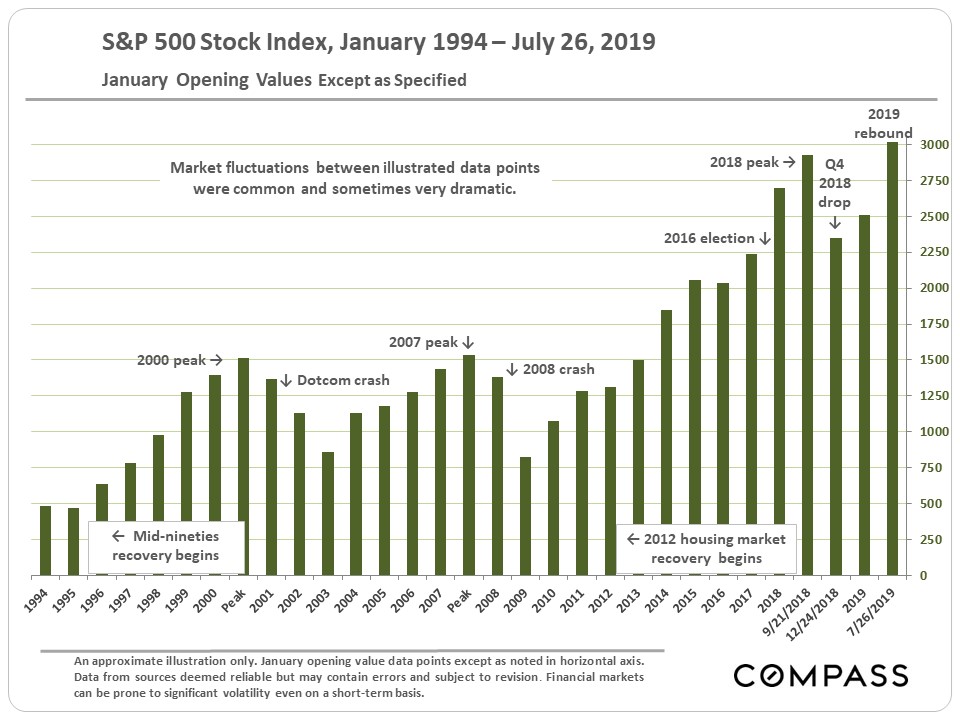

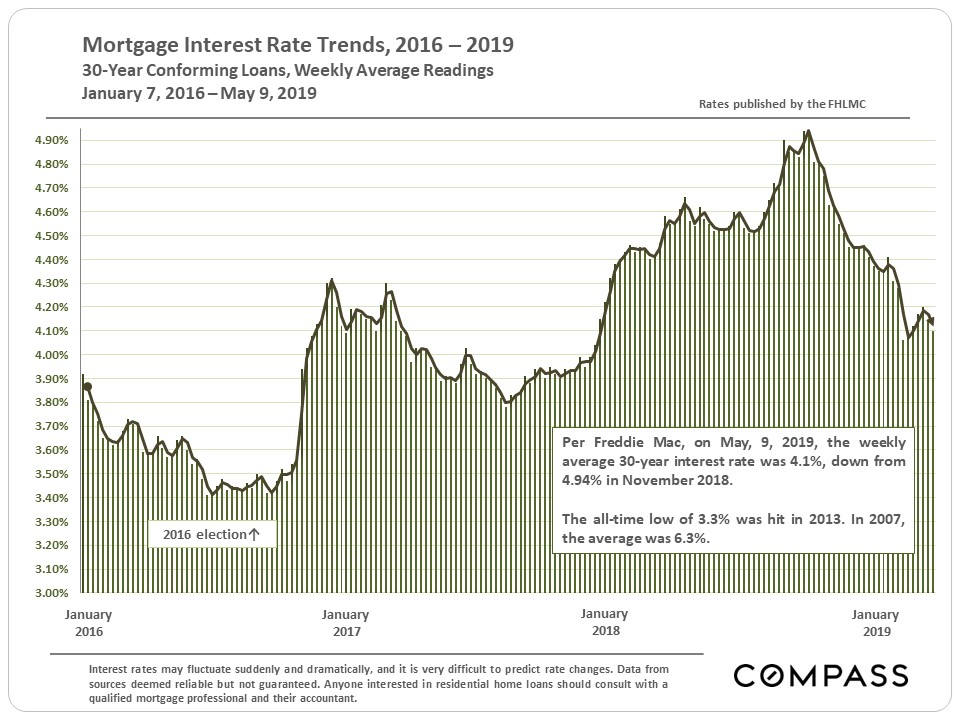

San Francisco median home sales prices increased dramatically in 2012, 2013, 2014, and and so once again in the kickoff half of 2015. In 2016, the SF market clearly cooled compared to the competitive frenzies of previous jump selling seasons, but in 2017 and and then far, in early 2018, the marketplace came roaring back again for perhaps its hottest market place since 2000. In summertime 2018, things cooled downwards significantly through the cease of the year - this coincided with extremely volatile stock markets and sharply rising interest rates. So, in 2019, stock markets soared once more to striking new peaks, involvement rates dropped to hit multi-year lows, and local high-tech unicorns went IPO in quantity: The spring 2019 market place rebounded dramatically, and in Q2 2019, median home sales prices surpassed the highs striking in 2018.

Median Toll Appreciation

Information technology's interesting to annotation that SF rents actually dropped much farther later on the dotcom bubble burst than after the 2008 fiscal markets crash, though the latter was a much more destructive economic event. It suggests that local rents may be more afflicted by the simple ebb and flow of high-tech hiring and employment than by other macro-economic issues, such equally stock market changes. If one loses one's job and the likelihood of finding another in the area plunges, information technology may be an immediate imperative to move to a less expensive rental surface area (pressuring rents lower); if one'due south net worth plunges with a stock market crash, ane may no longer afford to buy a home (pressuring home prices lower). This is an oversimplification, merely may nevertheless go some ways to explaining the unlike scale of reaction by buy and rental markets to unlike macro-economic events.

After peaking in 2015, the SF rental market place definitely cooled in 2016, with supply increasing significantly with new construction, demand softening (as the high-tech boom temporarily cooled), and rents beginning to decline, specially at the high stop. SF asking rents dropped around viii - 10% from their peaks in 2015. In 2018, some signs of recovery showed upwardly.

Stock Market (S&P 500 Alphabetize)

Consumer Confidence

******************************

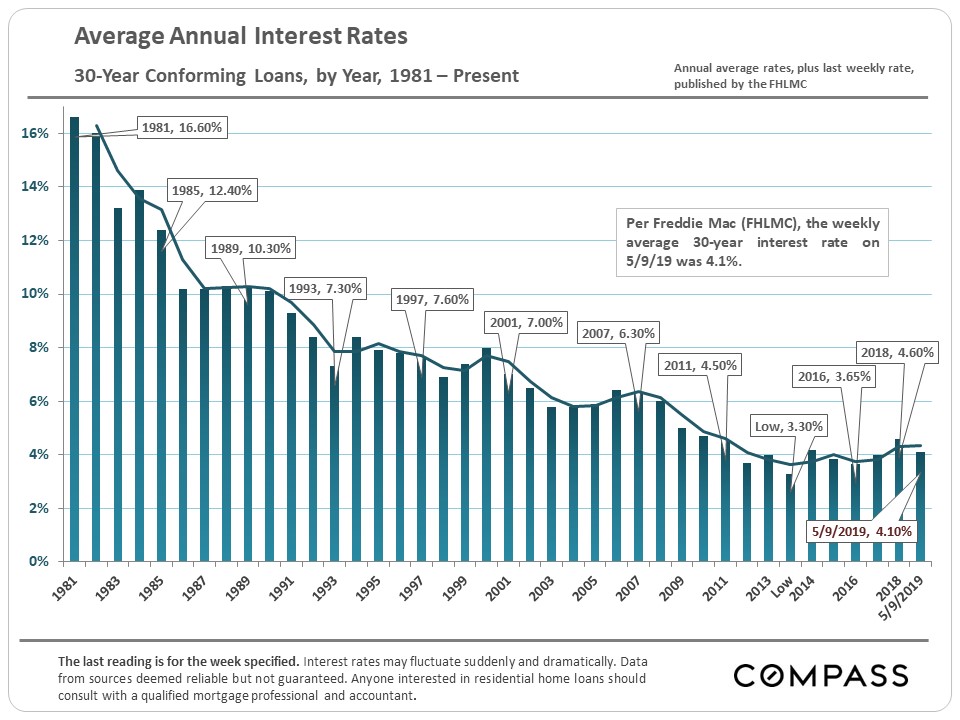

Mortgage Interest Rates since 1981Information technology's much harder to decipher whatsoever cycles in thirty-year mortgage rates. Rates remain very low by whatsoever historical measure, but take risen since the 2016 election. Involvement rates play a huge role in the ongoing toll of homeownership (affordability) and the existent manor market. The substantial decline in interest rates since 2007 has in effect subsidized much of the price increases that accept occurred since 2011.

******************************

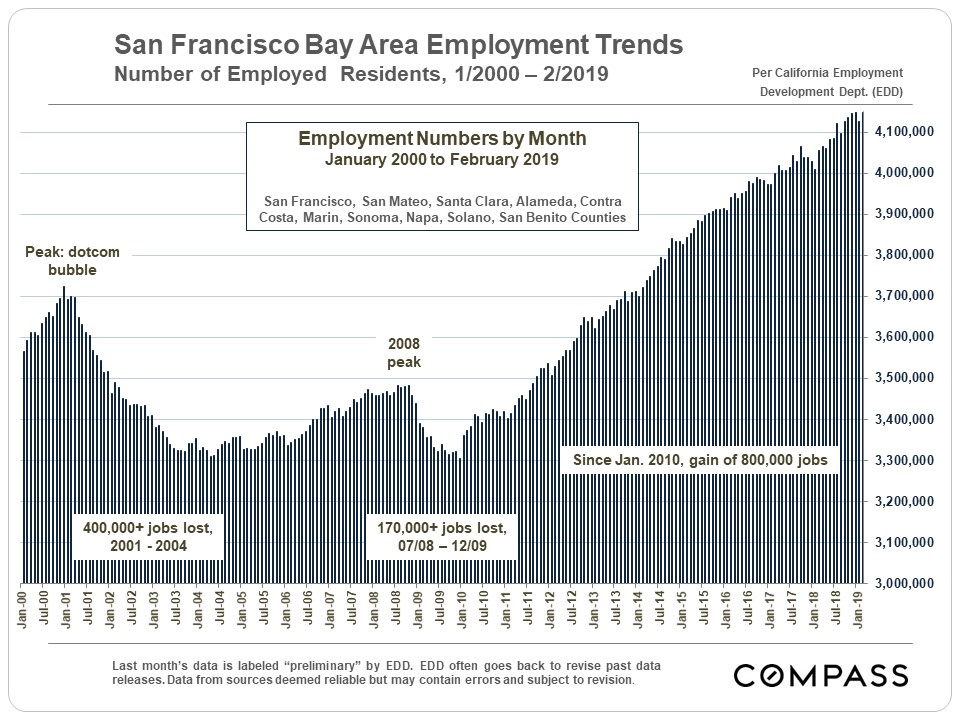

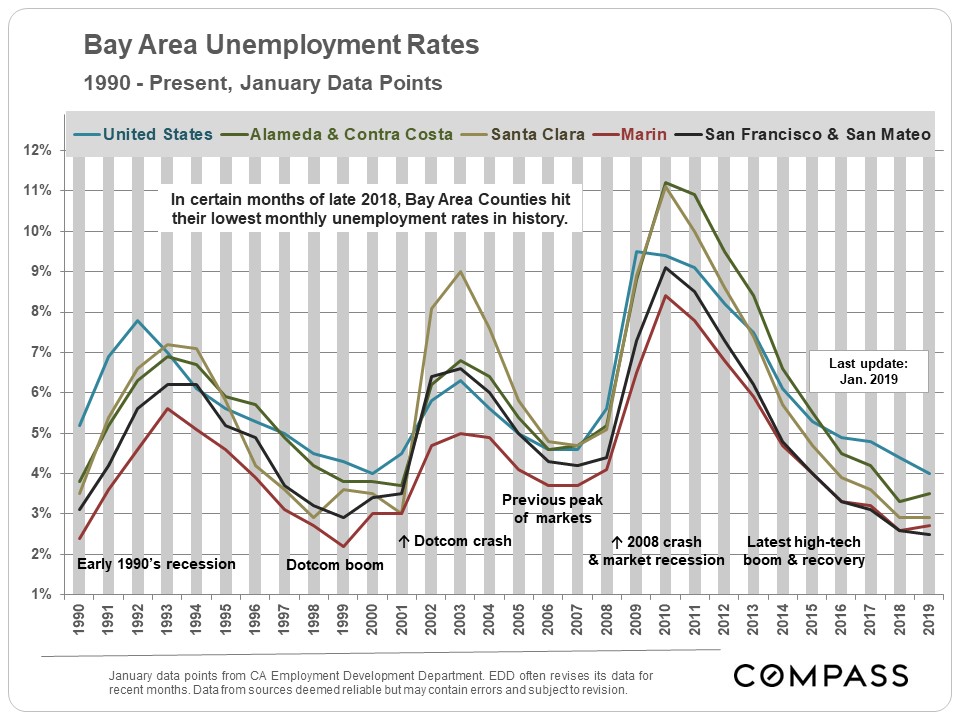

Employment Trends

******************************

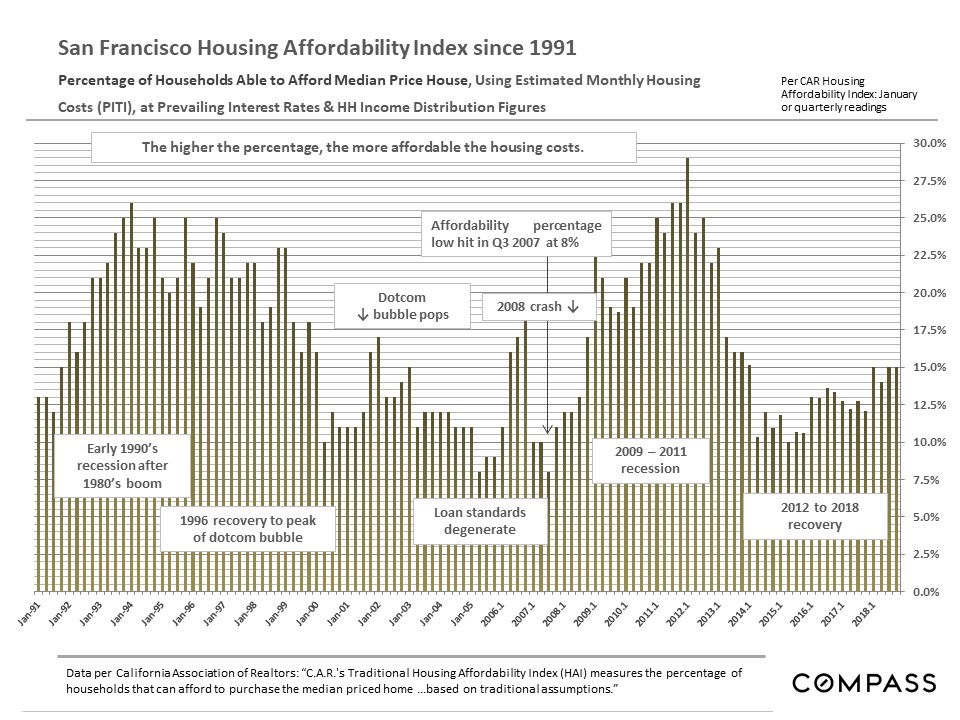

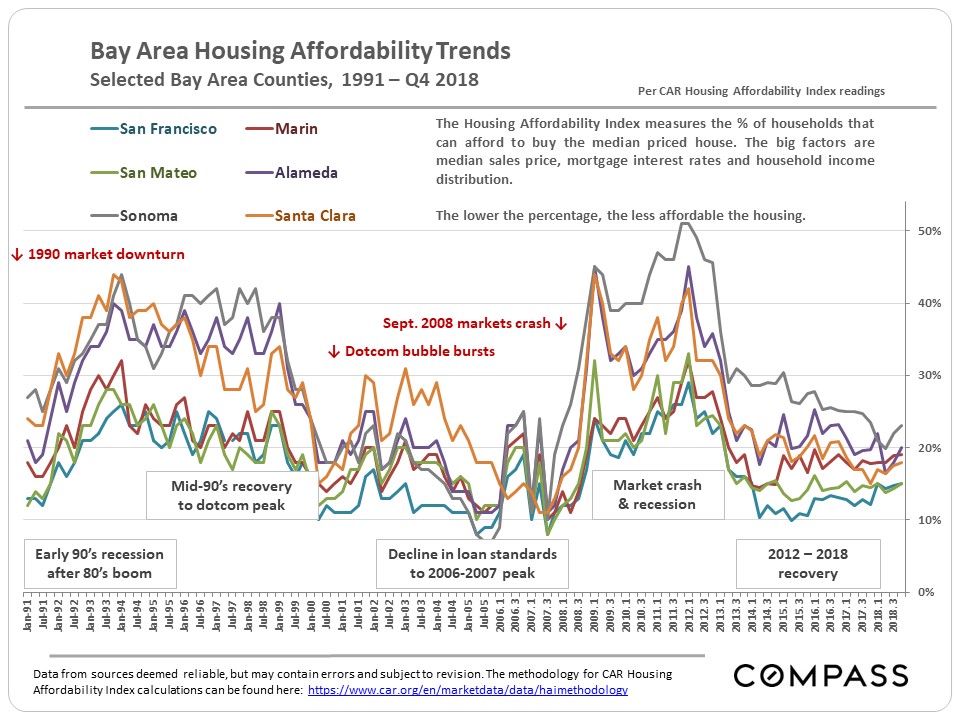

Housing Affordability Index (HAI) Cycles, 1991 - Presentfor San Francisco & Bay Area, per CA Clan of Realtors

The 2008 San Francisco Bay Area real manor crash was non caused just by a local affordability crisis: It was triggered by macro-economic events in financial markets which affected real estate markets across the country. It is important to note that in the by (certainly going dorsum at least 50 years), major corrections to Bay Area dwelling prices did not occur in isolation, just parallel to national economic events (though the 1989 earthquake, which occurred just earlier the national recession began, certainly exacerbated the local downturn). Ongoing speculation on local bubbles (and predictions of awful upcoming local crashes) oftentimes fail to remember this.

Still, dwindling affordability is certainly a symptom of overheating, of a market being pushed perhaps as well high. Looking at the charts above, it is interesting to note that the markets of all Bay Area counties hit similar and historic lows at previous market place peaks in 2006-2007, i.east. the pressure that began in the San Francisco market spread out to pressurize surrounding markets until all the areas bottomed out in affordability. This suggests that i factor or symptom of a correction, is not just a feverish San Francisco marketplace, merely that buyers cannot find affordable options anywhere in the area. Nosotros are certainly seeing that radiating pressure on home prices occurring now, starting in San Francisco and San Mateo (Silicon Valley) and surging out to all points of the compass.

Significant increases in mortgage interest rates - every bit happened in the second half of 2018 (before and so subsiding again in 2019) - touch on affordability quickly and dramatically, as involvement rates along with, of grade, housing prices and household incomes, play the dominant roles in this calculation.

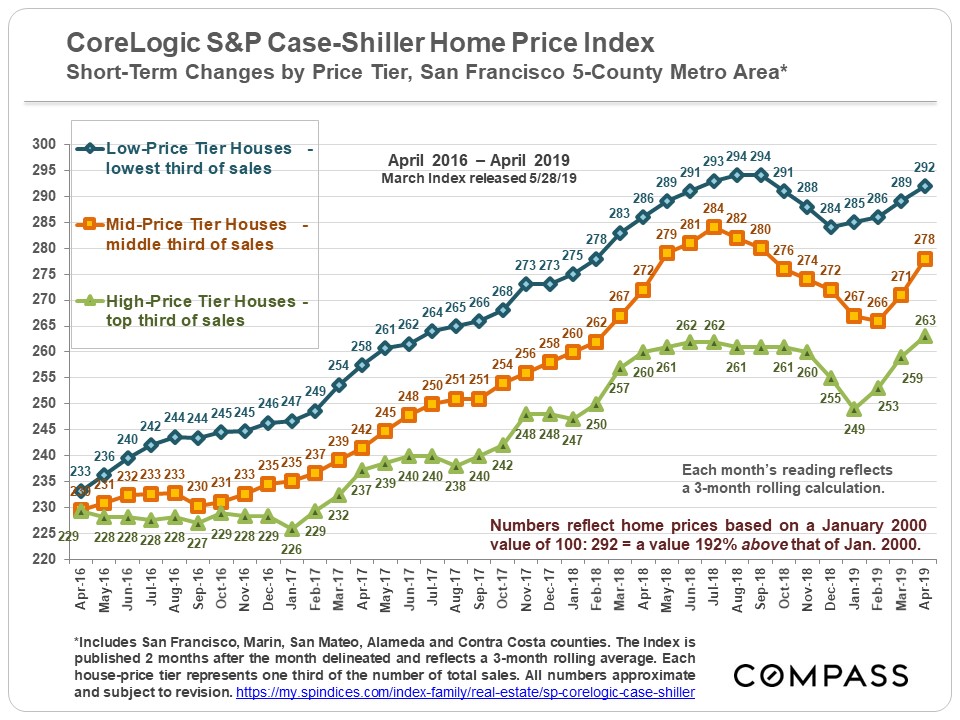

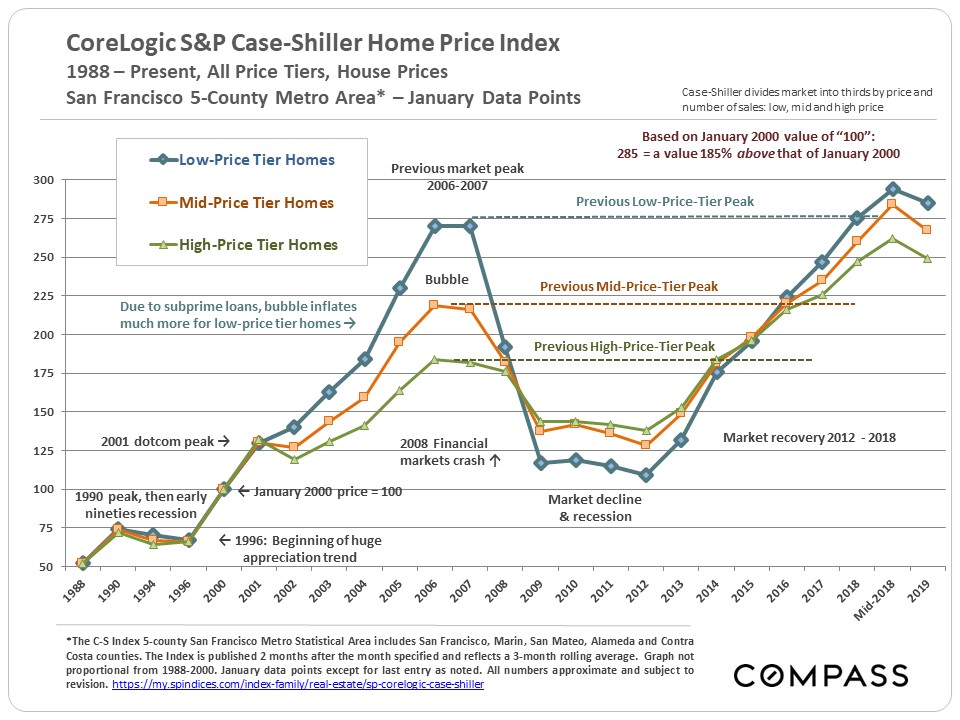

Dissimilar Bubbling, Crashes & Recoveries

The comparison composite chart dramatically illustrates the radically unlike market movements of different Bay Area housing price segments since 2000. Further beneath are updated individual price charts for each toll segment.

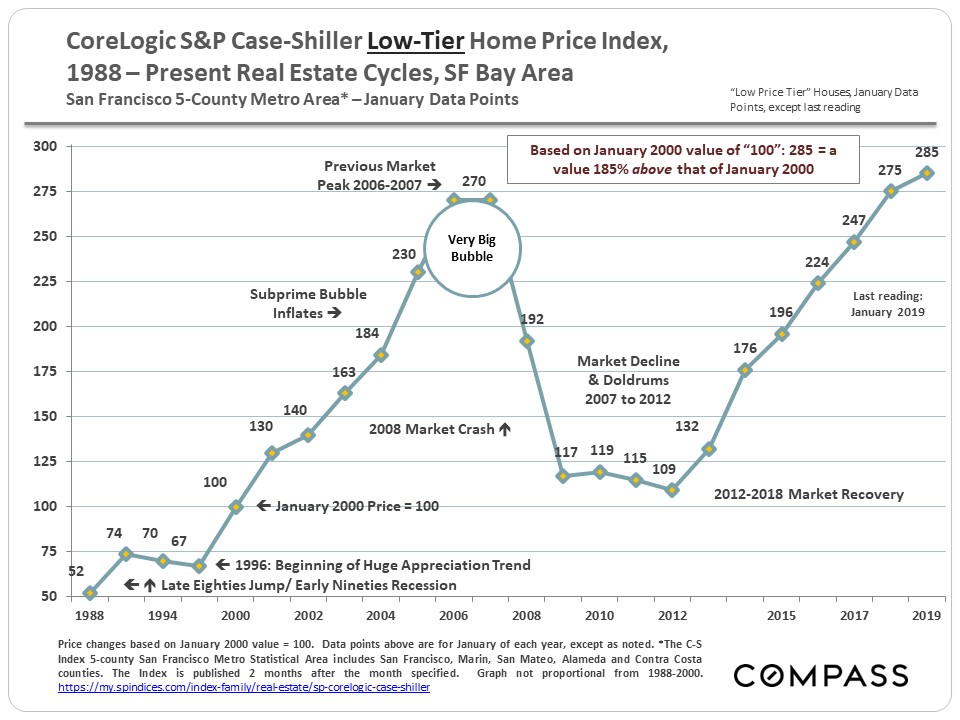

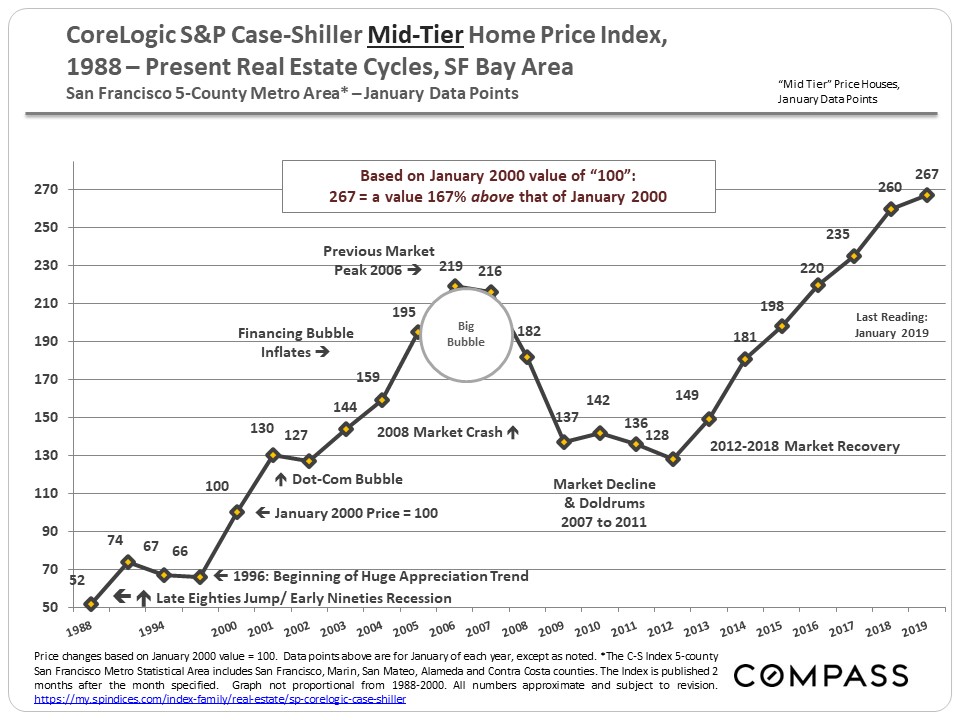

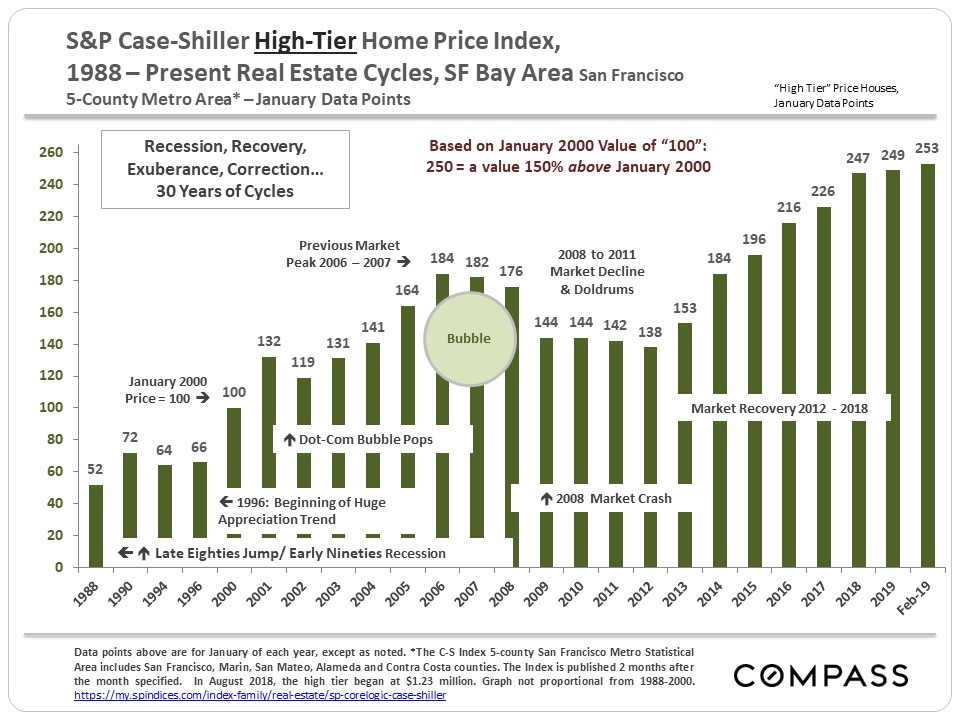

Once again, all numbers in the Case-Shiller chart relate to a January 2000 value of 100: A reading of 220 signifies a home value 120% above that of Jan 2000. The chart above illustrate how different market place segments in the 5-canton SF metro expanse had bubbling, crashes and now recoveries of enormously unlike magnitudes, mostly depending on the affect of subprime lending. The lower the price range, the bigger the bubble and crash. In the city itself, where many of our home sales would constitute an ultra-high price segment, if Case-Shiller bankrupt it out, many of our neighborhoods have risen to new peak values. Updated C-Southward charts for each price segment are below.

Since mid-2016, the depression-price tier has begun taking the atomic number 82 in dwelling house toll appreciation.

Huge subprime bubble (170% appreciation, 2000 - 2006) & huge crash

(60% decline, 2008 - 2011). Strong recovery, at present slightly to a higher place previous peak.

Smaller chimera (119% appreciation, 2000 - 2006) and crash (42% pass up)

than low-price tier. Strong recovery has put it significantly over its 2006 peak.

84% appreciation, 2000 - 2007, and 25% decline, superlative to bottom.

Now far to a higher place previous 2007 pinnacle values.

All our existent estate market reports can now be found hither:

San Francisco Bay Area Existent Estate Market Reports - Compass These analyses were fabricated in good religion with information from sources accounted reliable, merely they may contain errors and are field of study to revision. All numbers are guess and per centum changes will vary slightly depending on the verbal begin and end dates used for recoveries, peak prices and bottom-of-marketplace values.Compass is a real estate banker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to exist reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any limited or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to exist or should be read as any regulatory, legal, taxation, accounting or other communication and Compass does non provide such advice. All opinions are bailiwick to change without notice. Compass makes no representation regarding the accurateness of any statements regarding whatsoever references to the laws, statutes or regulations of any country are those of the author(due south). Past performance is no guarantee of future results.

Copyright 2019 Compass

Source: https://www.bayareamarketreports.com/trend/3-recessions-2-bubbles-and-a-baby

0 Response to "Are We Recession Bound Again Sf"

Post a Comment